Licensed in both North & South Carolina!

Licensed in both North & South Carolina!

Real estate terms to know

What is due diligence?

Simply put, due diligence funds are a sum of money that a buyer offers a seller in exchange for having time to thoroughly investigate the house. The due diligence money goes directly to the seller and is submitted at the time the offer is made. During this due diligence period, the buyer may choose to back out for any or no reason (but the seller gets to keep the due diligence money if the buyer backs out). If the deal continues to closing, the amount of money given in due diligence is credited towards the buyer. With some loans buyers can receive their due diligence money back. The bottom line is that buyers stand to lose this money if they back out and sellers like a high due diligence amount so this can be a make or break factor in whether or not an offer is accepted. Buyers typically want a long period of due diligence, where sellers would prefer a shorter due diligence period.

What is earnest money?

Earnest money checks are also written at the time the offer is made, but this money goes to an "escrow agent" such as the closing attorney or real estate brokerage and is held in a trust account until closing. The purpose of this check is to show how serious you are about buying the property.

What is dual agency?

When a brokerage firm represents both the buyer and seller, dual agency exists. As a seller, if you wanted your home to be exposed to the largest amount of buyers possible, you would want to authorize dual agency.

What is a buyer's agency agreement?

This is an agreement between an agent and a buyer that the agent will be loyal to you and represent you and your interests. Agents in NC must have a written agency agreement before they can prepare an offer on your behalf.

What is a seller's agency agreement?

This is an agreement between a seller and a brokerage firm, that the firm and its agents would represent you. This agreement is required before any marketing of your property may begin.

What is a CMA?

A CMA stands for Comparative Market Analysis. A competent agent can research your local market and compare your property to similar homes in the area based on a variety of factors. By looking at both houses that have and haven't closed, an agent can give you a good idea of what price is just right vs. what price is too high/won't sell. CMAs should not be confused with appraisals.

What is an appraisal?

An appraisal is performed by a licensed appraiser, not a real estate agent (unless they are also a licensed appraiser). Typically, a lender (bank) requires a buyer to pay for an appraisal to prove what the home is worth before funding a loan. If there is a difference between the appraised value and the sales price on the contract, buyers may have to pay the difference out of pocket.

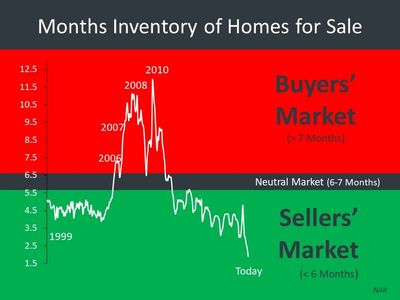

is now a good time to sell?

"My house isn't ready to put on the market yet. I still need to paint the garage" was recently said by a client of mine. After explaining that it is a sellers' market currently, I was able to convince my seller to get the house on the market without even worrying about the touchup items that are more important in a buyer's market. The result: multiple offers over asking price and cash in my seller's pocket without ever having to pick up a paintbrush! Don't wait. Call or text me now.